send link to app

US TAX Calculator app for iPhone and iPad

4.8 (

1408 ratings )

Finance

Developer: Amol Shejole

Free

Current version: 1.0, last update: 7 years agoFirst release : 21 Sep 2015

App size: 5.27 Mb

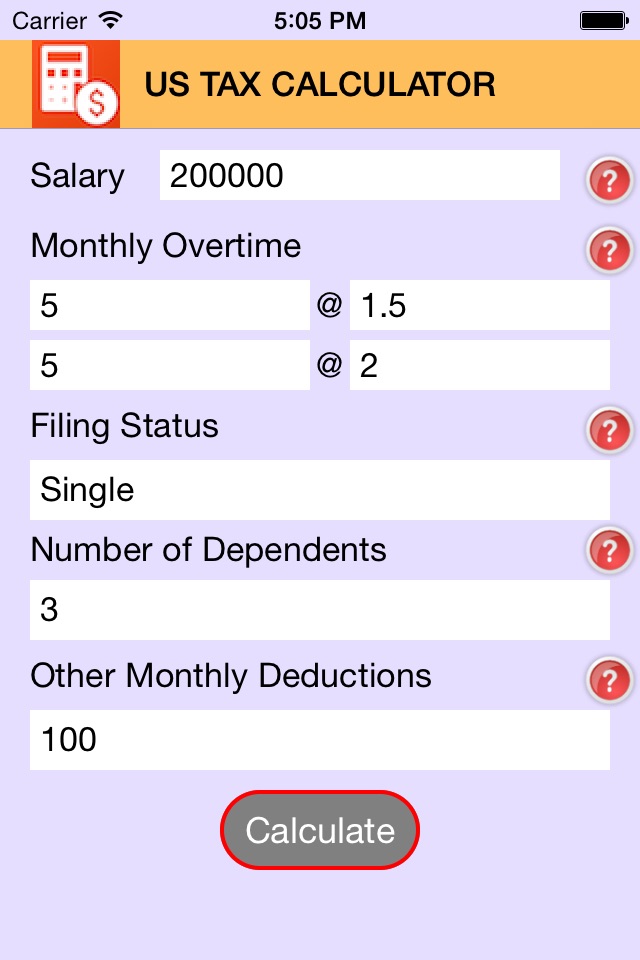

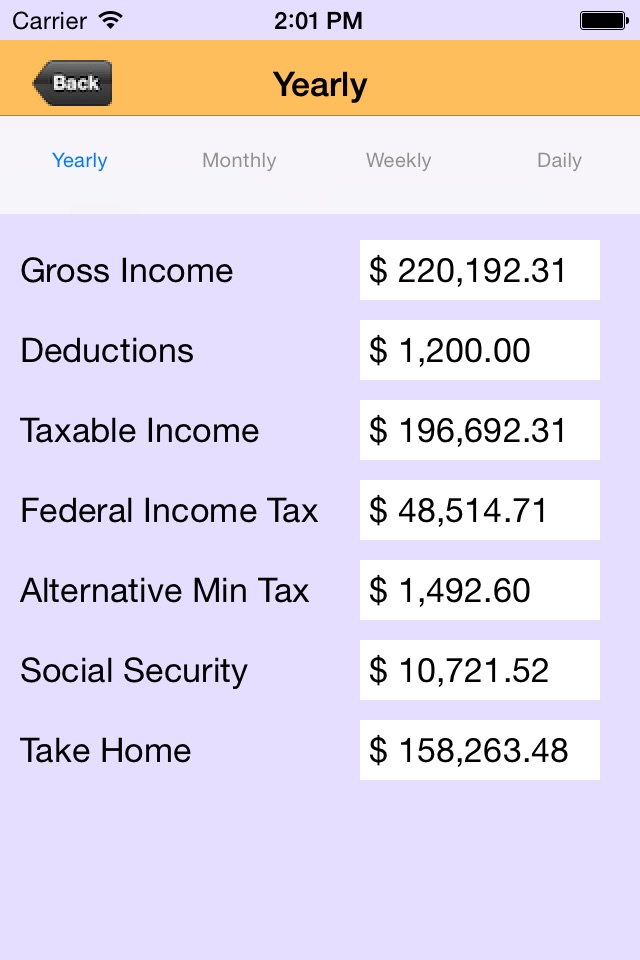

The United States tax Calculator uses Income tax information from the tax year 2015 to calculate the deductions made on a salary.

Federal Income tax is paid only on TAXABLE income, which is however much of your salary is left after the deductions have been made.

The tax is calculated according to US Tax deductions and rules.

This app is the easiest way to get your take home salary.